Financial Literacy Standards

7.Understanding the Responsibilities of Borrowing Money

People borrow money for a variety of reasons. Most of the time it’s to make a large purchase, such as a home or car, but borrowing money may also be necessary to pay for unexpected emergencies or to finance a college education. This module will outline the borrowing process and the responsibilities you’ll encounter while repaying the loan.

Section 1: Sources and Products related to Borrowing Money

A. Sources of Credit

You can borrow money from several places, each offering different benefits.

- Banks - Banks are financial institutions that hold and lend money to businesses and individuals. Making loans is one of the main functions of a bank and a significant way they generate income. Banks also offer a variety of credit cards to meet their customers’ needs.

- Credit Unions - Credit unions are not-for-profit organizations that offer loans and services to their members with more flexible terms and lower interest rates than traditional banks.

- Retail Businesses – Businesses use credit cards as a way to accept customer payments in their stores and online. Some stores even offer their own branded credit cards that can provide discounts for purchases made at their shops.

- Private Lenders - These lenders may be individuals or companies offering personal loans, sometimes with higher interest rates than traditional banks. Private lenders can, however, provide faster approval for a loan and may be more willing to negotiate interest rates and repayment terms.

- Federal Government – The federal government has programs that help with home ownership and small businesses, such as SBA (Small Business Administration) and FHA (Federal Housing Administration). The federal government is also the primary lender for federal student loans.

B. Credit Products

Credit products are financial tools that allow people or businesses to borrow money, with the agreement that they will pay it back later, with interest. Here are some common ways to borrow money.

- Credit Cards – Credit cards allow you to make a purchase, and you become responsible for repaying that amount to the credit card company. Most credit cards have monthly billing cycles and at the end of that cycle, you’ll receive a statement showing what you’ve purchased and how much you owe. If you don’t pay the full balance on your statement, you’ll be charged interest on the remaining amount.

- Car Loans – A car loan offers financing to eligible individuals when they purchase an automobile. The borrower receives the full amount of the car loan from the bank or credit union, and agrees to repay the money over a set period of time, with interest.

- Mortgages – When you purchase a home, it may be necessary for you to secure a mortgage. A mortgage is a loan used to purchase real estate. Banks, credit unions or other types of financial institutions provide mortgages to qualified borrowers. Generally, these loans must be repaid within a specified timeframe, which can range from 15 to 30 years.

C. Compare Sources of Student Loans

Student loans are borrowed money that assist students and their parents pay for college or post-secondary related expenses, such as tuition, housing, books, fees, and more. There are several types of loans that are funded through the federal government and private sources. These loans have different terms and requirements, but all must be repaid with interest.

- Federal Student Loans are typically the best first option because they offer:

- Lower interest rates

- More flexible repayment plans

- Options for postponing payment, such as deferment or forbearance

- A few opportunities for loan forgiveness

- Several different types of loans, such as:

- Direct Subsidized Loans

- For undergraduates with financial need

- Federal government pays the interest on these loans while the student is enrolled at least half-time

- Students must complete a FAFSA (Free Application for Federal Student Aid) in order to determine eligibility

- Direct Unsubsidized Loans

- For undergraduate, graduate and professional students

- This loan is not based on financial need

- Student is responsible for paying all interest after the loan is disbursed

- Direct PLUS Loans

- For parents of undergraduates

- A credit check is required

- These loans have a higher interest rate than other federal student loans

- Students must complete a FAFSA in order to determine eligibility

- Direct Subsidized Loans

- Private Student Loans can help cover gaps in education expenses after federal aid is used. Some conditions may be:

- A mandatory credit check, in most cases

- A co-signer, typically a parent or guardian

- Typically, higher interest rates than those of federal student loans

- Less flexible repayment options

- Rarely offer loan forgiveness or income-based repayment plans

- A completed FAFSA is not usually required

Section 2: The Influence of One’s Credit History on Borrowing Money and Sustaining Credit

Credit is the ability to borrow money now and repay it later, usually with interest. When you use a credit card, take out a loan, or finance a car or house, you’re using credit.

A. Establishing a Positive Credit History

Building a positive credit history is important for your financial future. Below are a few attributes of having good credit.

- Good credit means you’ll qualify for lower interest rates on loans you may have.

- Many employers these days review an applicant’s credit report as part of the hiring process. A good report suggests the person is responsible and trustworthy.

- When you apply for a loan or credit card, the lender will use your credit history to determine if they’ll approve your request.

B. How Credit Reports Are Used

A credit report is a detailed record of your credit history, assembled by credit bureaus, like Equifax, Experian and TransUnion. These reports tell lenders about your borrowing and repayment history. We encourage individuals to visit AnnualCreditReport.com to request a free copy of their credit report.

C. Information Contained in a Credit Report

A credit report includes:

- Your personal information

- Name

- Address

- Social Security number

- Public records on a credit report are legal records obtained from a court that relate to your financial obligations. If your record has a negative entry, it will be shown on your credit report and can significantly hurt your credit score. Most public records consist of bankruptcy filings.

- Bankruptcy is a legal process for individuals or businesses that cannot repay their debts. It provides a way to get relief from overwhelming financial obligations.

- Account information shows details about every credit account you’ve opened and how you’ve managed them. This may include your payment history and amounts owed on:

- Loans

- Credit cards

- Lines of credit

- Credit inquiries are when someone checks your credit report, such as a lender, employer, landlord, or even when you access your credit file.

D. What’s a Credit Score?

A credit score is a number that represents your creditworthiness, or simply, how likely you are to repay money that you borrow. The credit score also helps lenders decide whether to approve you for loans or credit cards, and then determine the interest rate or terms they should offer.

- Credit score ranges:

- 800-850 – Excellent

- Very low risk to lenders

- 740-799 – Very Good

- Low risk, meaning you will typically receive good terms on a loan

- 670-739 – Good

- You’re an average borrower and would be approved by most lenders

- 580-669 – Fair

- Some lenders may approve a loan at this score, but with higher interest rates

- 300-579 – Poor

- High risk; you may be denied

- 800-850 – Excellent

E. Factors That Affect a Credit Score

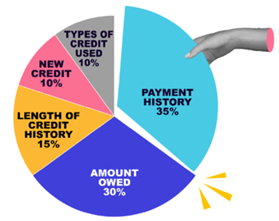

Your credit score is based on several factors that represent how responsibly you manage your debt. Scores, such as FICO (Fair Isaac Corporation) use this model to determine your score.

- Payment history – 35%

- This is the most important factor

- On-time payments help build a good credit score

- Late payments, collections and bankruptcies hurt your score

- Amounts owed – 30%

- Measures how much of your available credit you’re using

- Best to keep your credit utilization ratio under 30%, if possible

- Length of credit history – 15%

- The length of time your accounts have been open

- Reviews the age of your oldest, newest, and average accounts

- Longer credit histories help your score

- New credit – 10%

- Every time you apply for credit, a hard inquiry is made.

- Too many hard inquiries in a short period of time can hurt your credit score

- A soft inquiry, such as checking your own credit, doesn’t affect your credit score

- Types of credit used – 10%

- Lenders look favorably on someone who can manage different types of credit responsibly such as:

- Credit cards

- Car loans

- Student loans

- Mortgages

- Personal loans

- Lenders look favorably on someone who can manage different types of credit responsibly such as:

Section 3: The Process of Borrowing money

A. Identify Factors Involved in Borrowing

When you borrow money, lenders will consider several important factors to determine if your loan should be approved.

- Credit history – This is a record of how you’ve used the money you’ve borrowed, such as credit cards to student loans to car loans. Your credit history will also show how much debt you currently have and if you’ve paid your bills on time.

- Credit report – Your credit report will help the lender determine if you’re financially responsible and will pay the money back.

- Debt-to-income ratio – Measures how much of your monthly income goes toward paying debts. If you spend too much paying down loans you already have, your lender may worry you can’t handle further debt.

- Loan-to-value ratio – Measures the amount of money you’re asking to borrow, to the value of the asset you’re borrowing against. This ratio typically refers to purchasing a home or a car. If you need to borrow the majority of the price of the home or car, you’re seen as a bigger risk.

- Length of employment – When you apply for a loan, the lender will want to know if you have a steady income, and how long you’ve had it. The longer you’ve been at your job, the more financially stable you’ll appear to your lender.

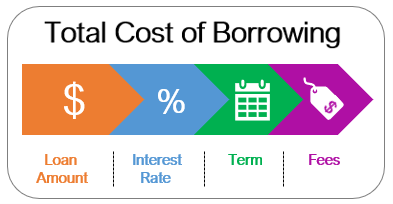

B. How the Terms of Borrowing Affect the Costs of Borrowing

- The terms of borrowing are the specific rules or conditions you agree to when you take out a loan or use credit.

- The costs of borrowing are the extra costs that make borrowing expensive, such as interest, annual fees, late payments, and more.

- Interest – Interest is what the lender charges you for using their money. At any time you borrow money or use credit, you are required to pay interest.

- APR (Annual Percentage Rate) – APR is the total yearly cost of borrowing money. This includes the interest charged by the lender as well as fees, like origination fees or closing costs.

- Fees – When you borrow money, you typically have to pay extra charges called fees.

- Origination fee – A fee charged for processing a new loan.

- Late fee – Charged if you miss a payment or pay after the due date.

- Prepayment penalty – A charge for paying off your loan early. This is not charged on all loans; check with your lender first if you plan to pay the entirety of your loan early.

- Application fee – A non-refundable fee charged simply to apply.

- Annual fee – This fee is charged to use certain credit cards, especially those that offer rewards.

- Balance transfer fee – A fee that’s charged when you move the debt from one credit card to another to obtain a better interest rate.

- Cash advance fee – Charged when you take cash from your credit card.

- Closing costs – This charge includes fees for home inspections, insurance, or appraisals on homes. Closing costs can be quite extensive.

- The repayment schedule you choose determines how much, when and how long you’ll pay back your loan. It affects your monthly budget, the overall total cost and your financial flexibility.

- The terms and conditions of your loan are the rules that explain what you’re borrowing, how you’ll pay it back and what it costs.

- Loan parties and amount – The parties of the loan will include you and your lender. The agreement will also show the principal, or the exact amount you’re borrowing.

- Interest rate and APR – The percentage charged on your loan may be fixed or variable.

- Fixed interest rate is a rate that doesn’t change for the entire term of your loan, even if the market rates rise or fall.

- Variable interest rate is a rate that can change over time. It can go up or down depending on what the prime rate is currently.

- The APR is the true yearly cost of your loan, including interest and fees.

- The loan term will explain how long you have to repay your loan. The repayment schedule will show you how much you’ll pay and when, whether it’s monthly, biweekly, lump sum, etc.

- Fees and penalties may be charged for taking out a loan, missing a payment or paying off your loan early. These items will be explained in your loan paperwork.

- Collateral is an asset of yours, like a car or house, that the lender can take if you do not repay your loan.

- Default is when you’ve missed a certain number of payments and your lender can seize your collateral or charge additional fees on your loan.

- Prepayment on a loan can often be a positive thing, but sometimes a lender will charge prepayment fees.

C. Compare Types of Credit

Types of credit you might use when borrowing money include:

- Revolving credit typically relates to credit cards where you have a set credit limit, you borrow up to that limit, pay it down and then borrow again. This type of credit is flexible and can build a good credit history. If you don’t pay off your credit card each month however, you can carry a balance which can lead to higher interest.

- Installment credit is a type of loan where you’re given the full lump sum to pay something off, but you make payments on it in fixed installments over a set period of time. You may pay a fixed amount with lower interest rates, but these types of loans may have a stricter approval process.

- A collateralized loan is backed by your collateral (a house for a mortgage or a car for an auto loan). Collateralized loans have lower interest rates and offer easier approval, but if you don’t pay back the money, you can lose your collateral.

- Unsecured loans do not require collateral so there is no risk of losing property. These loans are often quicker to obtain and sometimes have higher interest rates and harsh credit requirements.

D. Standard vs Predatory Lending Practices

- Standard loan practices exhibit fair terms such as:

- Clear terms – The terms for interest rates, fees and a comprehensive repayment schedule are fully disclosed.

- Reasonable interest rates and fees – These costs are aligned with market standards and are based on your credit risk.

- Underwriting – Underwriting is a process where lenders assess your income and debt before approval of the loan.

- No surprise penalties – Standard loan practices do not include hidden charges or fees for prepayment.

- Reputable collection – Respectful, legal processes are used if payments are missed.

- Predatory loan practices are often unethical or abusive and are designed to benefit the lender.

- Higher interest rates and fees – Most rates on predatory loans, or payday loans, are very high with extraordinarily high fees. Payday loans in Oklahoma can have an interest rate up to 204%; the highest average payday loan rate in the U.S. can be as high as 664%.

- Hidden charges – Some fees or unexpected charges are sometimes buried in the small print of the loan agreement.

- Balloon payment – This type of payment is usually small upfront, with a huge lump sum at the end of the loan term.

- Prepayment penalties – Fees may be charged to the borrower for paying off the loan early, thus trapping the borrower in extra debt.

- Loan flipping – Lenders may promote frequent financing to keep the loan going while racking up more fees.

- Deceptive sales tactics – Lenders may aggressively pressure borrowers with misleading claims while doing no credit checks.

- Rapid tax returns – These types of services allow you to file your federal tax return and receive your refund early by having the company front you the tax refund within 24 hours. Instead of paying for the tax service, the fees will come out of your refund. These loans can often have high fees and interest rates.

Section 4: The Responsibilities and Consequences of Borrowing Money

A. Consumer Responsibilities, Rights and Remedies

Consumers have a number of responsibilities, rights and remedies when borrowing or using financial products.

- Consumer responsibilities may include:

- Understanding loan terms – Borrowers are responsible for reading all loans terms and asking questions if they don’t understand the details. They should know what the interest will be, any fees charged and understand the payment schedule.

- Provide accurate information – The borrower must include truthful information about income, and any prior debts on loan applications. The borrower will also update the lender when anything of importance changes.

- Pay on time – Borrowers must make their payments on time to avoid penalties or risk damaging their credit.

- Protect personal data – All loan documents, passwords or PINs to borrower accounts should be kept confidential.

- Stay informed – Make sure you, as the borrower, are up-to-date on all details of the loan form.

- Report any issues – If you find errors or unfair practices being used by the lender, be sure to report the issue.

- Consumer rights are:

- Right to privacy – Your loan data must be kept secure and private.

- Right to dispute errors – Borrowers have the right to challenge incorrect charges or credit report errors.

- Right to transparent information – The lender must clearly share any information on the loan’s interest rate, fees, APR and repayment terms.

- Fair treatment – The borrower is protected from discrimination and abusive collection practices.

- Right to redress – Borrowers can seek refunds or compensation for any wrongdoing by the lender.

- Remedies for consumers include:

- Dispute errors – Borrowers can officially challenge billing or credit report mistakes. The lender must investigate the problem, and then correct it and respond to the borrower.

- File complaints – Borrowers have the right to file complaints with regulatory institutions such as the FTC (Federal Trade Commission) or CFPB (Consumer Financial Protection Board).

- Take legal action – If laws are violated, you may receive monetary funds for the damages as well as legal fees. Laws may include TILA (Truth in Lending Act), FCBA (Fair Credit Billing Act), or FCRA (Fair Credit Reporting Act).

- Prevent abuse – Debt collectors must follow the rules of no harassment, off-hour calls or misleading threats.

B. Responsible Borrowers Monitor Their Credit Reports

Regularly checking your credit report and correcting errors is crucial for your financial well-being. About 1 in 5 consumers have serious errors on at least one of their credit reports. (Federal Trade Commission)

- Detect fraud or identity theft early when monitoring your credit report frequently.

- Catch mistakes such as misreported late payments or incorrect balances, which can lower your credit score. When errors are corrected, it can improve your score and offer lower interest rates and better loan terms.

- An accurate credit report can help you avoid denied loans, blocked credit or losing out on a job opportunity.

- Consumers may request a free copy of their credit report from the three credit reporting agencies - Equifax, Experian and TransUnion. Visit AnnualCreditReport.com.

- To dispute any errors on your credit report, visit the individual credit agency websites and find their link for reporting mistakes.

C. The Impact of Non-Repayment of Debt

Not paying your debts can cause financial problems for you, your family, businesses, and the economy.

- Individuals and Families

- Unpaid debts and defaulting on loans can cause significant credit damage and hurt your credit score, making future borrowing on yourself and your family more expensive or even impossible.

- Avoiding payments can also cause higher interest rates, late fees and collection charges. These types of expenses can add up and be tough on your personal budget or that of your family members.

- Creditors may choose to sue, garnish your wages or seize your, or your families’ possessions when bills are left unpaid.

- Sometimes debt struggles are linked to anxiety, depression, strained relationships or even health problems.

- Businesses

- When customers or partners in the business fail to pay their bills, it can limit the businesses’ ability to operate, hire or grow.

- Persistent nonpayment can push a company into bankruptcy or force them to shut down completely.

- Unpaid business debts can trigger legal action, potentially leading to lawsuits, strained supplier relationships, and a damaged reputation.

- When a business fails to pay a debt, it can damage their credit which can making obtaining future credit less accessible and more expensive.

- Broader Economic Impact

- When individuals and/or businesses fail to pay their debts, lenders tend to raise rates or reduce lending to guard against further defaults.

- There can also be an economic slowdown, meaning if consumers are struggling, they spend less which will reduce business revenue.

- The risk of increased defaults nationwide can cause interest rates on all loans to rise.