Financial Literacy Standards

1. Earning an Income and Managing it Through Budgeting

Earning an income is essential for covering our basic

Earning an income is essential for covering our basic

needs and achieving our personal goals. It provides

the financial means to pay for necessities like food,

clothing, and housing, and it allows us to save for

future ambitions such as higher education, travel, or

purchasing a home.

Income also plays a crucial role in promoting

independence and self-sufficiency. It empowers

individuals to make choices about their lifestyle and

supports personal growth. On a larger scale, earning

an income contributes to economic growth, sustains

businesses, drives innovation, and enhances the overall quality of life in society.

Section 1: The Value of Work

A. Costs and benefits determine the achievement of your personal financial goals.

Costs are the money you spend or sacrifices you make to reach a goal, like paying for school or starting a business. Benefits are the good things you get from spending that money, like new skills, better jobs, or profits. By looking at both costs and benefits, you can decide if a goal is worth it and plan successfully.

B. Analyze how income, career choice, and entrepreneurship impact an individual's financial plan and goals.

Your chosen career, the salary you earn, and starting a new business can all influence your financial strategy and objectives. More income means more money for saving, investing, and spending. Different careers affect how much you earn, your overall job security, and how happy you are. Starting a business can help you earn a lot, but also comes with risks. Think about these factors when making your financial plans.

C. The relationship between a person's human capital and their earning potential.

Human capital includes elements such as education, skills, training, interests, and initiative. These factors contribute to securing better employment opportunities and increasing earning potential. Investing in yourself through education and enhancing acquired skills, increases your chances of achieving financial success.

Section 2: Understanding the Free Application for Federal Student Aid (FAFSA) and why it’s essential in providing financial aid to students.

The FAFSA is a student’s first step in applying for all types of federal and state financial assistance for college. The information entered on this form by both students and their parents will determine eligibility for grants and certain scholarships, considered free money, in addition to the college work-study program. This program enables students to secure employment either on-campus or, in some cases, off-campus, to earn income. Furthermore, the FAFSA is a prerequisite for students or parents intending to apply for a federal student loan.

Seniors are required to complete a FAFSA after Oct. 1

of their senior year (at FAFSA.gov), and each year

they need funding for post-secondary education.

Starting with the graduating class of 2024-25,

Oklahoma enacted legislation that mandates

FAFSA completion as a requirement for public high

school graduation.

For those seeking information and resources regarding

the FAFSA, please visit StudentAid.gov and UCanGo2.org.

Accurately and promptly completing the FAFSA can

significantly assist in making higher education more

affordable.

Section 3: Managing personal income and expenses to be financially responsible.

A. Understanding certain factors that can affect your income.

A pay stub is a document that shows the details of your pay for a specific period. It’s typically given along with, or attached to, a paycheck. A pay stub includes important information such as:

- Gross pay is your total earnings before any deductions have been made.

- Net pay is the take-home amount after all deductions have been subtracted from the gross pay.

- Deductions include federal, state and local taxes, if applicable; FICA (Social Security and Medicare taxes), and voluntary deductions like retirement savings and health insurance.

Understanding your pay stub will help employees know where their money is going and can be useful for budgeting.

B. Learn how SMART goals can help you differentiate between needs and wants to achieve financial responsibility.

SMART goals provide a framework for setting clear, effective goals that are easier to track and achieve. The acronym SMART stands for:

Setting SMART goals enables you to more easily manage your money as you’re prioritizing between wants and needs. This framework helps reveal whether your goal is a need, meaning it’s essential and aligned with values or survival, or a want which is something nice to have, but not critical. Needs may include housing, food, utilities, or transportation. Wants may be eating out twice a week, buying the latest iPhone, or subscribing to streaming services for your TV or tablet. Let’s take it one further. Obligations may be things you don’t always need or want, but you’re legally bound to pay them. For example, this could include student loan payments, child support, or tax obligations.

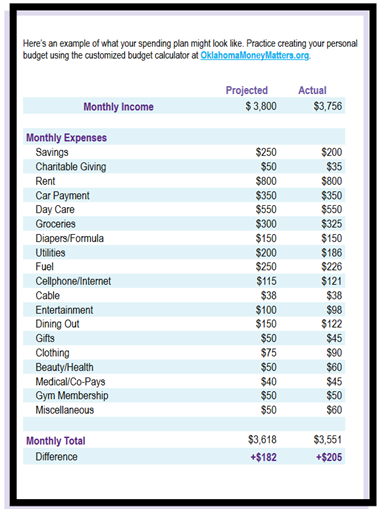

Section 4: Creating a budget for yourself or your family.

Budgeting is the process of creating a plan to manage your money.

It allows you to track your income, or that of your family, set spending limits and prioritize your goals.

The components of a budget may include:

- Salary or wages – Income earned from work.

- Savings – Always put money in your savings account before paying your bills, if possible.

- Investments – This may be money deducted from your paycheck, or money you choose to invest on your own.

- Government benefits – SNAP for food assistance, health insurance, welfare, etc.

- Side jobs – Money earned from your hobbies or a part- time job you may have.

- Child support or alimony – Money you pay, or receive, to help with raising your child or assisting an ex-spouse.

- Charitable giving – Donations of money or goods to organizations that benefit society.

- Taxes – Federal and state income taxes, property tax, payroll tax, etc.

- Emergency Fund – Money you set aside to cover unexpected or unplanned expenses.

Your budget should also detail the fixed and variable expenses you pay on an annual or monthly basis. Don’t forget to include money for unexpected events or emergencies.

Fixed expenses stay the same every month. Some examples may include:

- Housing – Rent or mortgage payments

- Insurance – Health, auto, home

- Loans – Car payment, student loans

- Childcare – Daycare or after-school programs for children

Variable expenses may change from month to month, depending on usage.

- Groceries – Food, cleaning supplies, pet food

- Utilities – Electricity, gas, water, internet and streaming services

- Entertainment – Movies, ballgames, eating out

- Clothing – Special occasions, seasonal shopping, etc.

- Transportation – Gas and oil for car, parking, public transportation

Section 5: Tracking your income and expenses

Using strategies like budgeting, financial software, and expense journals to track income and expenses can be very helpful ways to successfully manage your money. These methods help you plan for regular expenses like bills and groceries, and unexpected costs like medical emergencies or car repairs. Reviewing and adjusting your spending plans regularly keeps your finances stable and helps you meet your goals.

Follow these steps to track your income and expenses.

- Know your monthly income – Include all types of money you may receive each month from jobs, gifts or helping around the house. Adults might also include tax refunds, and child or spousal support.

- Your financial responsibilities – Are you paying for a car or bike to get you to and from school? Maybe you’re living on your own so you have rent and utility payments monthly. Track your spending on groceries, gas and entertainment. These expenses change periodically so keep an average amount spent in mind.

- Track your spending – Hang onto your receipts and write down all financial transactions for one month so you can get an accurate picture of your spending habits.

- Categorize your spending – Now gather your receipts and put them all together in similar categories, like "dining out," "entertainment," "groceries," etc. Based on your current spending, assign each category a monthly amount.

- Do the math – Now you can subtract your predicted expenses from your projected income. What happened? If you’re already over budget, refine a few of your variable expense categories and try again. Once you’ve found a budget that works for you, you’re well on your way to managing your money!