Financial Literacy Standards

4. Managing and Reconciling Your Financial Accounts

Keeping accurate financial accounts is important for effectively managing your money, making smart decisions, and avoiding issues such as debt and financial instability. This module will outline the significance of maintaining precise financial records, methods for opening and managing checking and savings accounts, as well as explaining the benefits of balancing your records and efficiently overseeing your accounts.

Section 1: Purpose of Maintaining Financial Accounts

When your financial records are accurate, you can clearly see how much money you have, how much you spend, and how much you save. This helps you make informed decisions regarding your finances. Accurate records also help you identify additional savings opportunities and ensure that you have sufficient funds to cover your purchases. Additionally, financial records are very important documents that you’ll need when filing your tax return and seeking loans or credit.

A. Steps for opening an Account:

- Research and Choose a Financial Institution - Research a variety of banks and credit unions to find one that you feel will best meet your needs.

- Do you need a checking account or a savings account, or both?

- Will you need a loan in the near future?

- How’s the institution’s customer service?

- Do they offer online services?

- Gather Necessary Documents – To open an account, you may need the following documents:

- An ID, such as a current driver's license, Real ID or a passport

- Proof of where you live; this might require a utility bill or credit card statement with your name and address shown

- Your Social Security card or possibly just the number; an ITIN

- Complete the Application - Apply online or in person by providing the bank with the information and documents necessary to open an account.

- Make an Initial Deposit – Most financial institutions will require a small deposit, $25-$100, to open an account. You may be able to do this with cash, a check, or an electronic transfer.

- Set Up and Start Using Your Account - After your account is open you should:

- Set up online banking

- Enroll in direct deposit

- Establish account alerts

- Activate your debit card

B. Maintaining an Account

- Monitor Your Account Regularly - Check your account balance and transactions often to ensure accuracy and identify any potential problems.

- Update Personal Information – Keep your bank updated on any new addresses, phone numbers or email accounts so you don’t miss out on important alerts or notices.

- Review Account Statements – Be sure to examine your monthly bank statements to ensure that all transactions and fees are accurate.

- Utilize Account Tools – Take advantage of online banking, mobile apps, and other resources from your bank to manage your account efficiently.

C. Balancing Personal Records and Reconciling Account Statements

Why balance your bank account monthly? Here’s why:

- Ensure Accuracy - Balancing your financial records ensures your account balance is correct and matches the bank's records.

- Identify Errors - Reconciling helps you identify any errors or unauthorized transactions that require correction.

- Avoid Overdrafts - Maintaining accurate records helps you avoid spending more money than you actually have in your account, thus incurring fees.

- Maintain Financial Discipline: Regularly balancing and reconciling your account enables you to manage your finances effectively and make better budgeting decisions.

Section 2: Developing Useful Account Management Skills

A. Adding and Withdrawing Funds from Financial Accounts

Successfully managing your finances involves understanding how to deposit money into your account and how to withdraw money from your account in a safe and efficient manner. Below, you will find several methods to achieve this.

- Direct Deposit – Direct deposit allows your employer to send your paycheck, or other income, directly to your account.

- Mobile Deposit – Mobile deposit is a transfer of your money using your bank's app to deposit checks by taking a photo of them. You can also deposit money using a mobile device such as PayPal, Venmo or Cash App.

- Teller Deposit – This method allows you to deposit cash or checks directly into your account with a teller at a bank branch location.

- Debit Withdrawals – You may utilize your debit card for making purchases, as well as withdrawing cash directly from an ATM. Please be aware that some out-of-network ATM machines may charge you a fee upon withdrawal.

B. Performing Basic Account Management Skills

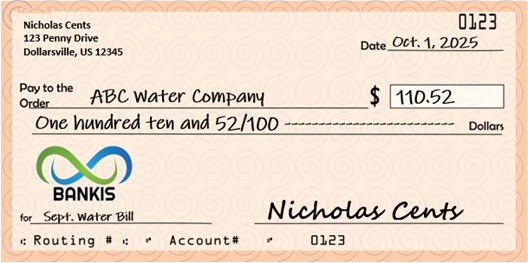

- Writing Checks - Writing a check is a simple method to pay someone directly from your bank account without using cash or electronic payments. Begin by completing your check with the current date, the full name of the payee or company, and the accurate amount in dollars and cents. Next, write out the amount in words and represent the cents as 75/100. The memo line serves to assist you in keeping track of the payment, although it’s not mandatory. Finally, simply sign your name as it appears on the check. See the sample check below.

- Endorsing Checks - Endorsing a check tells the bank that you authorize the check to be cashed or deposited. You must sign the back of the check using the name exactly as it appears on the front.

- Depositing Checks - Depositing a check means putting the money from that check into your bank account. You can deposit a check using an ATM, a mobile app, or in person.

C. Managing Financial Accounts

Managing your financial accounts allows you to protect yourself from errors and fraudulent activities. It’s crucial to consistently monitor your money.

- Reading and Reconciling Statements – A bank statement is a summary of all your transactions in your account over a set period, usually a month. Reviewing these statements is an essential part of managing your finances. It helps ensure your records match the bank’s.

- Navigating Online Platforms and Apps - Use online banking and mobile apps to manage your account, pay bills and transfer money — anytime, anywhere.

D. Potential Consequences of Account Mismanagement

Mismanaging your bank account can result in serious financial setbacks. Not tracking your balance, missing payments or ignoring fees can lead to severe complications.

- Insufficient Funds - When you don’t have enough money in your bank account to cover a payment or purchase, you have insufficient funds. This situation can result in overdraft fees and bounced checks.

- Overdraft Processing - Exceeding your account balance by spending more than you have, can lead to overdraft fees and a negative balance.

- Associated Fees - Mismanaging your account can result in various fees, such as late payment fees, maintenance fees, and penalties for not having enough money in your account to cover your expenses.

By keeping accurate financial records and developing strong management skills, you can ensure financial stability, avoid problems, and make smart choices about your money. Consistently monitoring and reconciling your accounts, understanding the process of adding and withdrawing funds, and recognizing the consequences of mismanagement are key to achieving financial security and success.