Financial Literacy Standards

10. Costs and Benefits of Renting vs. Buying a Home

Everyone has to have a place to live, and that means one of two things: renting or buying. Even in the best of times, this is a tricky issue, and the housing market can fluctuate so rapidly that it may seem challenging to make an informed choice. Here are a few considerations to ponder, to assist you in making this decision in the future.

Section 1: Renting vs Buying

Renting: What are the pros and cons of renting?

- Cost Efficiency – Depending on interest rates, renting can be a more budget-friendly choice than owning. You typically handle only the rent and utilities. When you own, you also need to consider insurance and taxes, which can really drive up the costs. If mortgage rates are high, renting could be the smarter move for you.

- Freedom – When you rent, you’re not stuck in one place for too long. You have a lease, and once it has expired, you can look for a new place to live, if that’s what you want. Owning is more of a long-term commitment, and getting out of a mortgage is trickier than ending a lease.

- Maintenance Costs – Owning means you get to call the shots, but it also means you’re responsible for all the expenses. Usually, renters just take care of normal wear and tear and maintenance. That’s a great way to save some cash!

- Fewer Financial Choices – Owning comes with a lot of decisions and sacrifices. When you own, you might have to pick between a vacation and a new water heater. Renting, on the other hand, involves fewer tough choices. If you don’t want to be tied down to a house and the financial perks aren’t a big deal for you, renting could be the best option.

Buying: What are the pros and cons of buying?

- Equity – Simply put, equity is the value you've built up in your home. It's the financial interest you hold in your property. While there's no guarantee of a return on investment, real estate has historically been one of the safest options. Purchasing a home, reducing your mortgage, and allowing it to appreciate in value is a tried-and-true method, so if you can swing it, it can be a smart investment choice.

- Stability – A fixed-rate mortgage means you'll have a consistent payment throughout the loan's duration. Sure, some costs like property taxes and insurance might fluctuate, but having the same mortgage payment each month can really help with budgeting and saving compared to renting.

- Tax Benefits – You can deduct the interest on your mortgage up to a certain limit. This is a significant advantage over renting. Plus, when you sell your home, you can often avoid hefty capital gains taxes, which can save you a lot of cash.

- Adaptability – Renting comes with a lot of restrictions set by landlords or property management. Can you paint the walls? Change the appliances? Have pets? Make renovations? When you own your home, the answer to all those questions is yes, because you have the power to make those decisions. Turning a house into a home is one of the best reasons to buy.

Section 2: Standard lease agreements

Here are the key elements typically found in a standard lease agreement, along with considerations specific to Oklahoma law.

- Parties and property

- Landlord and Tenant Information: Full legal names and contact information of both the property manager and all tenants residing in the property.

- Property Description: Address of the rental unit, including any specific features including parking space, garage, or yard.

- Property Usage: Specify that the property is for residential dwelling purposes only.

- Lease term and rent

- Lease Term: The exact start and end dates of the tenancy should be explicitly specified.

- Rent Amount: The exact monthly rent amount.

- Due Date: The day of the month when rent is due. If no date is specified, Oklahoma law defaults to the beginning of each month.

- Payment Methods: Acceptable payment methods such as check, electronic transfer, cash.

- Deposits and fees

- Security Deposit:

- Amount: In Oklahoma, there is no legal limit to the amount a landlord can charge for a security deposit. However, typical security deposits are equal to one- or two-months’ rent.

- Purpose: The security deposit is intended to cover potential damages beyond normal wear and tear, unpaid rent, and other lease violations.

- Pet Deposits/Fees: Landlords can charge separate pet deposits, which may be refundable or non-refundable. There is no legal limit on the amount that can be charged for pet deposits in Oklahoma.

- Late Fees:

- Enforceability: Landlords can charge late fees for unpaid rent, but the fees must be reasonable and correlated to the actual costs incurred due to late payment.

- Grace Period: Oklahoma law does not require landlords to offer a grace period for rent payments before assessing late fees. However, many landlords offer a grace period of 3-5 days as a courtesy and for improved tenant relations.

- Utilities and maintenance

- Utilities: The lease agreement must specify which utilities (such as, water, electricity, gas, trash removal) are the responsibility of the tenant and which are included in the rent or paid by the landlord.

- Maintenance Responsibilities:

- Landlord: Responsible for keeping the property in a safe condition, including making necessary repairs to essential systems (such as, electrical, plumbing, heating, air-conditioning) and maintaining common areas.

- Tenant: Responsible for keeping their living space clean, not causing damage beyond normal wear and tear, and reporting needed repairs promptly.

- Other important clauses

- Rules and Regulations: Include any specific rules or policies regarding pets, smoking, guests, noise levels, parking, etc.

- Entry to Property: Landlords in Oklahoma must provide at least 24 hours' notice before entering the property, except in emergencies.

- Termination and Renewal Procedures: Outline the procedures for terminating the lease agreement.

- Security Deposit:

Section 3: Financial considerations of purchasing a home

Purchasing a home is a significant financial undertaking. Several key considerations include affordability, down payment, closing costs, mortgage options, ongoing expenses, and long-term financial planning. A realistic budget, factoring in all costs, is crucial to avoid overextending yourself.

Mortgage Loans

A mortgage is a type of loan used to purchase or maintain a home, land, or other types of real estate. The borrower agrees to pay the lender over time, typically in a series of regular payments that are divided into principal and interest. The property then serves as collateral to secure the loan. Mortgages tend to have more favorable terms than other types of borrowing.

A borrower must apply for a mortgage through their preferred lender and meet several requirements, including minimum credit scores and down payments. Mortgage applications undergo a rigorous underwriting process before they reach the closing phase. Mortgage types, such as conventional or fixed-rate loans, vary based on the borrower's needs.

- Fixed rate – The standard mortgage is fixed rate. This means the interest will stay the same for the entire term of the loan, and so will the borrower’s monthly payments toward the mortgage. This is also called a traditional mortgage.

- Adjustable-Rate Mortgage (ARM) – With an ARM, the interest rate is fixed for an initial term, after which it can change based on prevailing interest rates. Often, the initial rate is below market, which can make this kind of mortgage more affordable in the short term, but possibly less affordable as the loan matures. ARMs do tend to have limits or caps on how high the interest rate can rise each time it adjusts.

- Reverse mortgage – These are designed for older homeowners who want to convert the equity of their home into cash. They can borrow against the value of their home and receive a lump sum of money. If the borrower moves or sells the home however, the entire amount might become due.

- Principal – The original amount of money you borrowed from the lender to purchase a home, excluding interest, taxes and insurance.

- Interest – The cost you pay to borrow from your lender, usually a percentage of the amount you borrowed. This can be fixed or adjustable, based on the terms of your mortgage.

- Down payment – The down payment is the initial amount you pay upfront when purchasing a home. It’s typically a percentage of the home’s purchase price and it reduces the amount you need to borrow from the lender.

- Escrow Account – An escrow account is a reserve set aside by your mortgage lender. When you make your monthly mortgage payment, the taxes and insurance portion is placed into an escrow account and your lender pays those bills for you when they come due. This is helpful for many homeowners to reduce large surprise annual payments.

- Property taxes – Property taxes are annual taxes that homeowners must pay to local governments (like counties, cities, or school districts) based on the value of their home and land.

- Insurance – Homeowners insurance is a policy you buy to protect your home and belongings from damage or loss due to certain risks such as fire, storm, theft or accidents.

- Late fees and grace periods - If you miss your monthly mortgage payment, you'll likely face a late fee, although most mortgage contracts include a grace period. The grace period is a set timeframe after your due date (typically 15 days, but check your loan documents) during which you can still make your payment without incurring a late fee. For instance, if your payment is due on the 1st, a 15-day grace period means you have until the 16th to pay without a penalty. However, if you pay after the grace period ends, your lender will likely charge a late fee. This fee is usually a percentage of the overdue payment amount, commonly ranging from 4% to 5%.

- Early payment penalties - A prepayment penalty on a home mortgage is a fee that lenders may charge if you pay off your loan early, typically within a certain number of years. These penalties are designed to offset the interest income the lender would have earned if the loan had been paid off as scheduled. Prepayment penalties are not always included in mortgage agreements, but when they are, they can vary in structure and amount.

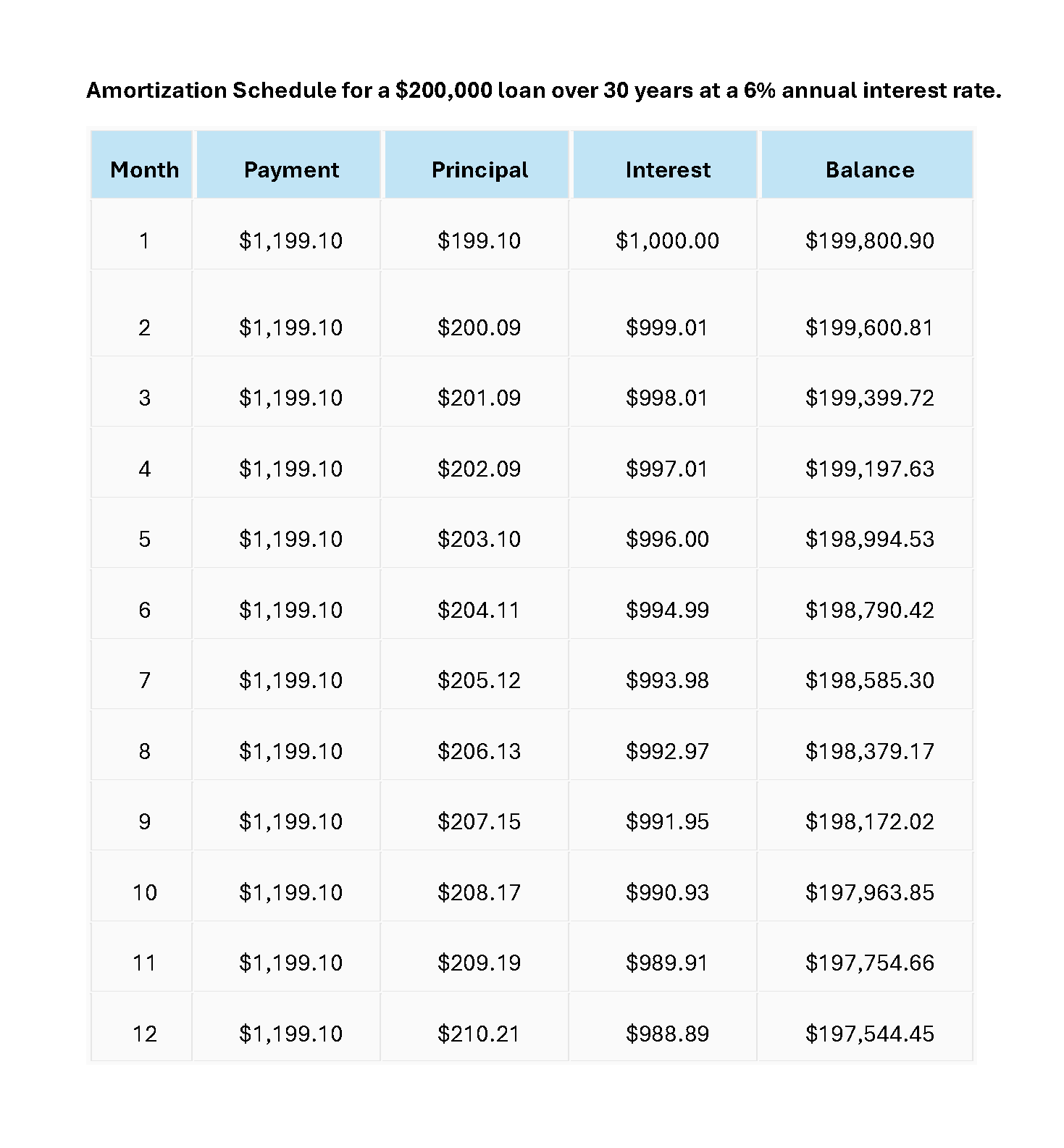

- Amortization tables - An amortization table breaks down each mortgage payment into its principal and interest components, showing how your loan balance decreases over time. It helps you understand how much of your payment goes toward reducing the loan amount (principal) versus how much is paid as interest, and it tracks the remaining loan balance throughout the mortgage term.

A. Types of lenders and mortgage loans

Mortgages come in various forms. The most common types are 30-year and 15-year fixed-rate mortgages. Some mortgage terms are as short as five years, while others can run 40 years or longer. Stretching payments over a longer period of time may reduce the monthly payment, but can also increase the total amount of interest the borrower pays over the life of the loan.

B. Elements of a mortgage

The elements of a mortgage include: