Financial Literacy Standards

2. The Impact of Local, State and Federal Taxes

Taxes are mandatory payments that people and businesses must pay to the government. This money is used to pay for things we all use, like roads, schools, and public services. Paying taxes is important because it helps our communities and country work well.

Section 1: The Importance of Paying Taxes

A. Types of Taxes

- Income Tax - This is taken from the money you earn from working or running a business. Usually,

you pay this tax once a year. - Payroll Tax - Tax that is taken out of your paycheck to pay for things like Social Security benefits and Medicare. Your employer takes care of this.

- Sales Tax - You pay this tax when you buy things at a store. The store sends the money to the government.

- Property Tax - If you own a house or land, you pay this tax based on how much your property is worth. This is usually paid once or twice a year.

B. Uses of Tax Money

-

Local Level - Taxes pay for things in your town, such as expenses for the police and fire departments, road maintenance, preservation of parks, playgrounds and sporting venues, as well as local government services.

-

State Level - Taxes pay for state-wide services like schools, teacher salaries, healthcare and vaccination programs, construction and maintenance of state highways and bridges, as well as public programs such as child and family services and assistance for disabled or elderly individuals.

-

Federal Level - Taxes pay for national services like the Department of Defense and national security efforts abroad, Social Security and Medicare payments for retirees, big infrastructure projects across the country, and funding for federal financial aid programs, such as the Pell Grant and student loans to assist students in paying for college expenses.

Section 2: Why Meeting Tax obligations is Important

It’s important to pay your taxes because it helps keep your community and country running smoothly. This money supports services that everyone uses and needs. Without taxes, government couldn’t provide the services, protections, and infrastructure that make everyday life safe, fair, and functional.

A. How to File Taxes

You must file a federal, and sometimes state, tax return annually if you make more than a certain amount of money. Some common tax forms are:

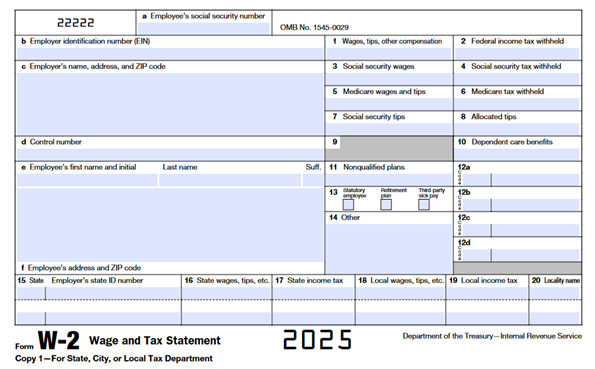

- W-2 - The W-2 form is given to you by your employer. It shows how much money you earned from your job in a year, and how much tax was taken out. See example below.

- W-4 - The W-4 form tells your employer how much tax to withhold from your paycheck.

- 1040 - The 1040 is the main form you use to report your income and figure out how much tax you owe.

B. What Happens If You Fail to Pay Your Taxes

If you don’t pay your taxes, there can be serious consequences, including:

- Fees and Penalties - You might have to pay extra money for filing your taxes late or incorrectly. Late payment penalties are usually 0.5% of the unpaid tax per month, or up to 25%.

- Interest - You might have to pay interest on the money you owe for your taxes.

- Garnishment of Wages - The government might take part of your paycheck to pay your tax debt.

- Imprisonment - In very bad cases, you could go to jail for not paying your taxes.

C. Tax Refunds

In some cases, the government gives money back to you after filing your taxes. This is called a tax refund. You may receive a refund if you paid more in taxes throughout the year than you actually owed. About 70-75% of individual taxpayers receive a refund each year.

Understanding and paying your taxes helps make sure your community has the money it needs to provide important services for everyone. Taxes are an important part of making sure society runs well and supports everyone’s needs.