Setting Up a Budget

Looking for the secret to financial success? The answer is the same whether you have $50 in your pocket or $5 million. Set up a budget, also known as a spending plan.

BUT, you say...

- “Budgets are boring.”

- “They’re restrictive.”

- “I don’t have many bills so I don’t need one.”

Budgets may not thrill you, but having more money will. A budget is simply a plan for spending your money. It’s an empowering tool that lets you to see at a glance where your money is going, no matter how much or how little you have. Whether you change your spending habits is completely up to you.

::Getting Started::

- Dollarbird (iOS, Android)

- Pockeguard (iOS, Android)

- You Need a Budget (iOS, Windows Phone)

- Expensify (iOS, Android, Windows Phone)

- Pocket Expense (iOS)

Identify your Income

Add up your paystubs, tips and yes, even financial support received from your family to determine how much income you bring in each month.

Evaluate your Expenses

There are two types of expenses: fixed and variable. Fixed expenses are easier to manage, because they don’t change from month to month. Rent is a great example of a fixed expense. Variable expenses are a bit harder to plan for, because they often change – like fuel, groceries and utilities. Tracking your expenses can help you plan for variable expenses. For at least one month, write down everything you spend; even small purchases like a pack of gum or snack out of a vending machine.

Create Categories

After you’ve tracked your spending, identify patterns. These patterns represent your budget categories. Some categories are obvious, like food and rent. Others are more specific to you, like entertainment or trips to the coffee shop. Use your spending categories to create your budget, using our customizable budget calculator, an app or spreadsheet. If you choose a premade budget template, remember to customize it with categories that fit your lifestyle and spending habits.

Plan for Saving

Unfortunately, there’s one more type of expense: unexpected. A budget helps you plan for expected expenses, but what happens when your car breaks down, you need to go to the emergency room or you get a parking ticket? Create a savings category in your budget so you won’t panic when you have a sudden, unplanned expense. Even if you can only save $10 a paycheck, that’s a start. Having an emergency fund turns a potential crisis into an inconvenience and helps you avoid busting your budget.

Once you build your emergency fund, you can start working on short– and long–term savings goals. Short-term savings goals might be a vacation or concert tickets. Long- term savings allows you to build wealth, invest and eventually retire.

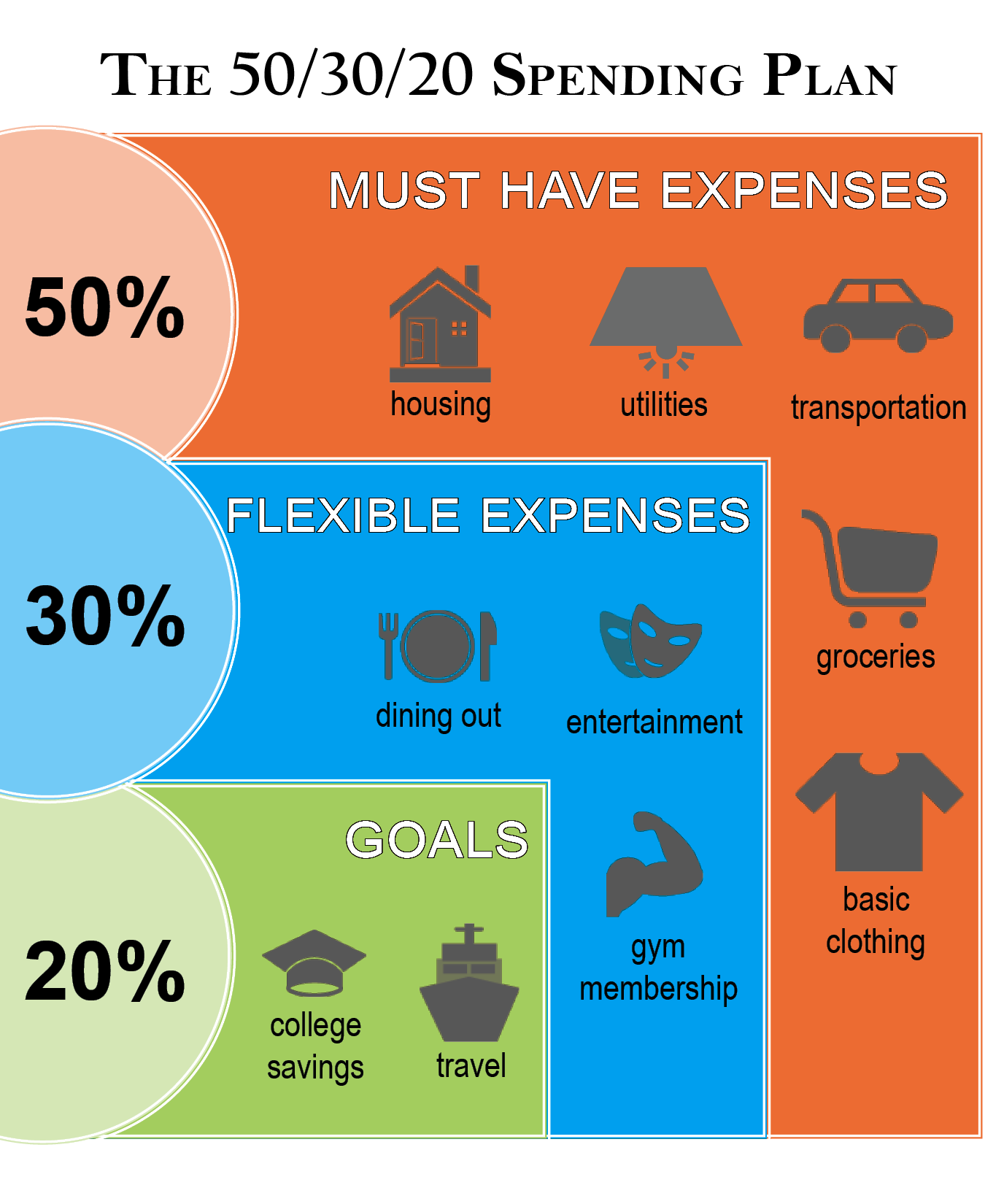

One common method to break down a budget is the 50/30/20 spending plan. As shown in the image below, you would allocate 50% of your income to essential expenses, such as housing, transportation and groceries; 30% to flexible expenses, like dining out and entertainment; and 20% to savings to cover unexpected costs, build an emergency fund, and meet personal or family goals, such as college planning, travel, and retirement.

::Budgeting Alternatives::

Writing income and expenses down isn’t the only way to approach budgeting; consider these alternatives. And remember, you may need to try several methods to find the one that works best for you.

Budget Buckets

This method relies on access to online banking and your ability to successfully manage three bank accounts-two checking and one savings.

First, decide how much of every paycheck you want to put toward savings and have that amount direct deposited into your savings account. Next, send the rest of your paycheck to checking account No. 1 to pay all monthly fixed expenses. Then, divide the remaining money by four and set up a weekly automatic transfer of that amount to checking account No. 2 to pay for your variable expenses.

Envelope Budgeting

Grab some envelopes and write the name of a budget category on each one - every category gets its own envelope. Then, place your budgeted amount of cash for that category in the envelope. Spend as you normally would, but once the cash is spent, there’s no more spending in that category until your next pay period. Practice extra caution with your envelopes, if your cash is lost or stolen, there's no replacing your money. Invest in a fireproof and waterproof safety lockbox to keep your cash protected at all times.

Tech Options

There are many apps, online budgeting tools and software programs that can help you keep track of your spending. Many options will even simplify the process by importing data directly from your financial institutions and credit companies. Remember, always do your own research before signing up for a product.

Here are a few websites to check out:

If you prefer to use an app, visit your provider’s app store for available options. Here are some suggestions to explore: