College Planning

Begin setting aside funds for your child’s education by putting a modest amount monthly into a savings account and adding more as your finances allow. The earlier you start saving, the more time your money has to grow. Although the thought of paying for college seems daunting, it’s essential to take action now.

529 Plans

A 529 college savings plan offers a simple way to save money for your child’s college education, and can maximize your saving efforts. Each state is different; however, one of the key elements to a 529 plan is that you pay no taxes on the account’s earnings.

The Oklahoma 529 college savings plan offers several advantages, including an Oklahoma tax deduction, a choice of investment options and the funds can be used at thousands of higher education institutions in the U.S. and abroad.

For more information about Oklahoma’s 529 college savings plan, call 877.654.7284 or visit Oklahoma529.org.

Plan for Expenses

It’s important to understand how much college will cost. College expenses vary depending on the type of school attended, the number of courses taken, the student's major and their personal lifestyle.

OKcollegestart.org helps students and their families plan for higher education in Oklahoma. To determine if your family is saving enough money for college, explore this chart highlighting estimated expenses or use this calculator from the College Savings Plan Network.

Minimize the Cost

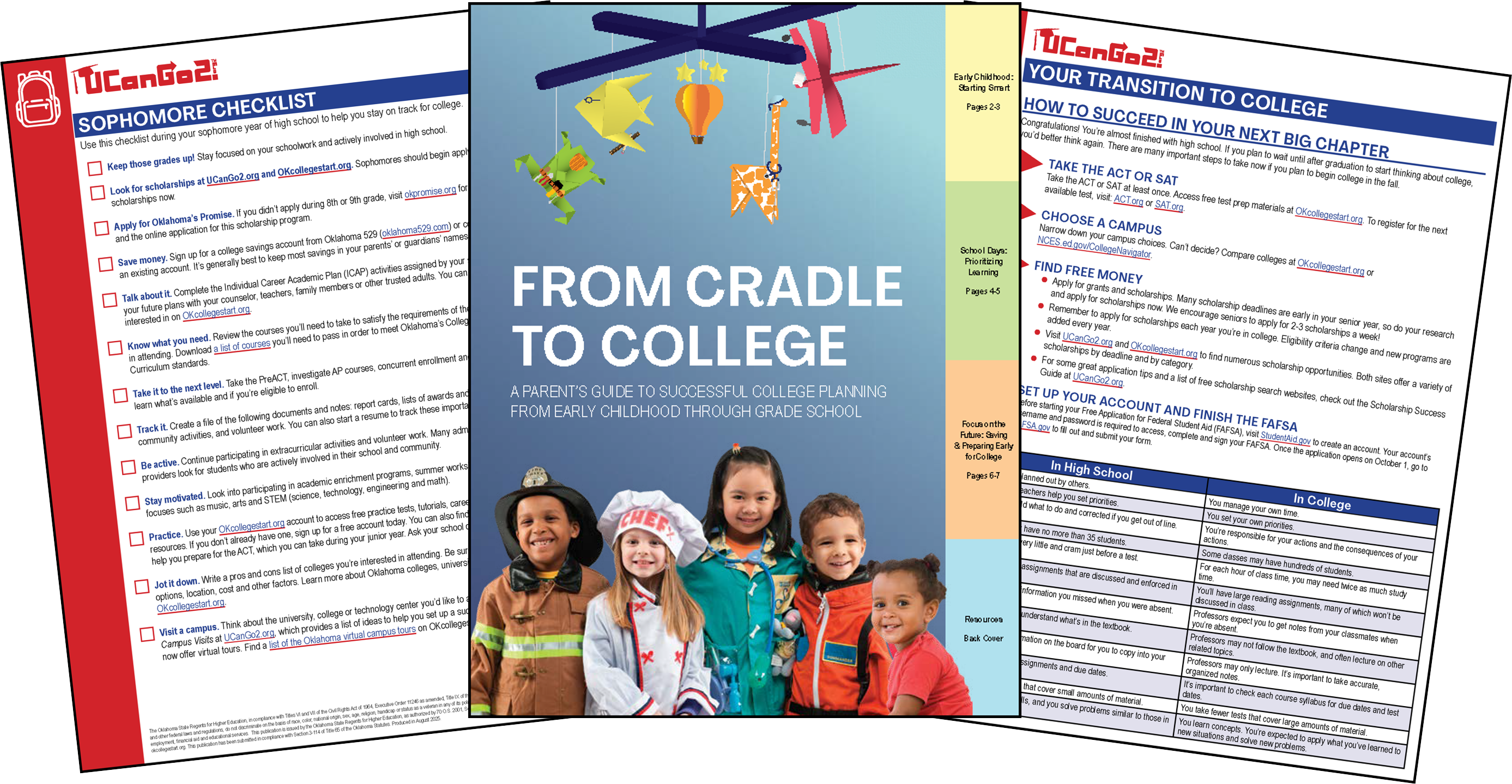

There are a variety of ways to manage and minimize the cost of your child's education. In addition to this list, visit UCanGo2.org for a wide range of publications to educate you on preparing and paying for college. While there, download the From Cradle to College booklet to learn how to prepare for your child's education early-on.

- Concurrent enrollment. This program allows eligible high school juniors and seniors to take up to six hours of credit-earning college courses, per semester. Tuition is at a discounted rate and classes can be transferred to some post-secondary institutions for college credit.

- Advanced Placement (AP) courses.These courses allow your child to take college level coursework in high school. Many Oklahoma colleges and universities award college credit to students who successfully complete these courses and pass the corresponding AP exams.

- College-Level Examination Program (CLEP). The CLEP program consists of 34 tests in a variety of subjects and gives your child the opportunity to earn college credit based on what they already knows. This process is often referred to as “testing-out” and can save your child time and you money. Visit the CLEP college search to see if your child's chosen college accepts CLEP.

- Cheaper solutions. Taking basic courses at a community college or living at home for the first few years of school are all great ways to slash college costs while still receiving a quality education and college experience.

Find Financial Aid

Encourage your child to apply for grants and scholarships; they’re a great way to pay for school. One of the most popular scholarships in our state is Oklahoma's Promise. Your child must apply between 8th grade and December 31 of their senior year, and meet other enrollment criteria. Students may also qualify if their parent or guardian is an Oklahoma public school teacher. To learn more, visit OKPromise.org.

Encourage your child to apply for grants and scholarships; they’re a great way to pay for school. One of the most popular scholarships in our state is Oklahoma's Promise. Your child must apply between 8th grade and December 31 of their senior year, and meet other enrollment criteria. Students may also qualify if their parent or guardian is an Oklahoma public school teacher. To learn more, visit OKPromise.org.

It's also important to complete the Free Application for Federal Student Aid (FAFSA) even if you think your family makes too much money. The FAFSA is required for all Oklahoma’s Promise students. Submit the FAFSA as soon as it becomes available on October 1 each year. The official FAFSA website is FAFSA.gov. To learn more about the FAFSA process, visit StartWithFAFSA.org.

After maximizing grants, scholarships, federal work-study opportunities and family savings, federal student loans are a low-cost option for bridging the gap when paying for school. For more information about federal student loans, including common loan terminology, tips for responsible borrowing and repayment options, visit StudentAid.gov. You can also review the helpful information under OKMM’s Student Loan Borrowers tab.