Adult Learners

Getting out of Debt

It is crucial to get out of debt because it provides financial and personal benefits. Carrying debt, particularly high-interest forms like credit card debt, can drain your cash flow through interest payments and make it challenging to reach financial goals like saving for retirement or a down payment on a home.

The debt snowball method is a debt repayment strategy that prioritizes paying off debts from the smallest balance to the largest, regardless of their interest rates. This approach aims to boost motivation and keep you on track by providing quick wins as you eliminate smaller debts first.

There are three things you should know:

- The success of the debt snowball depends on dedicating extra money to pay toward your debt. Find extra money by cutting cable TV and any streaming services, limiting eating out or earning extra income. Do what you can to aggressively attack your debt. In the example below, we use $200; if you can’t afford $200, start with $50 or $100. To make the snowball work you must find a way to pay extra on your debt.

- Since tackling debt requires a behavioral change, aim for quick results by paying off your smallest debt first. This helps you feel a sense of accomplishment and motivates you to continue with the process.

- The extra money you allot to debt reduction (see number 1 below) will be added to the minimum payment on your smallest debt. Pay this increased amount while continuing to pay the required minimum on all other accounts.

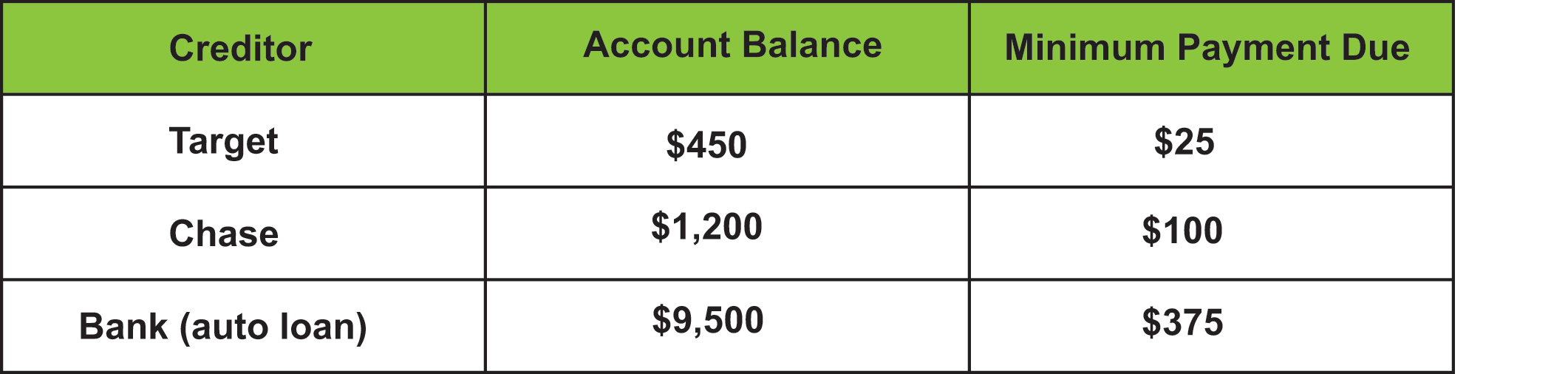

First, list all your debts from smallest to largest. List everything except your mortgage; you can focus on that later. List the creditor's name, the account balance and minimum payment due for all debts. Your list may look something like this:

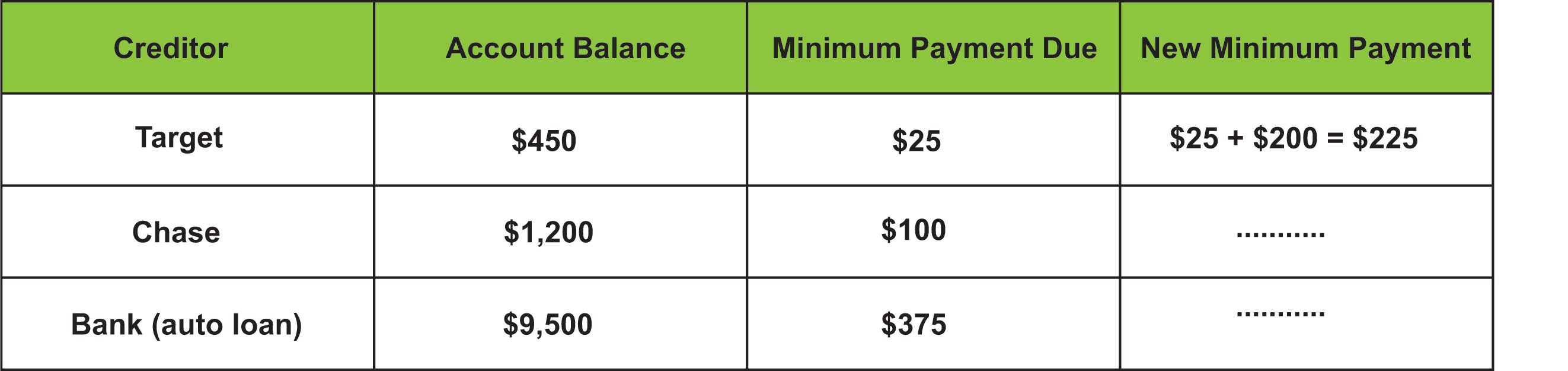

Next, using the extra money you identified — $200, in this example — increase the minimum payment on your lowest debt. Remember to continue making the required minimum payment on all other debt. Here’s what that looks like:

So, the first month of your debt snowball you’ll pay Target $225, Chase $100 and your bank $375. After only two months, the Target card will be paid off!

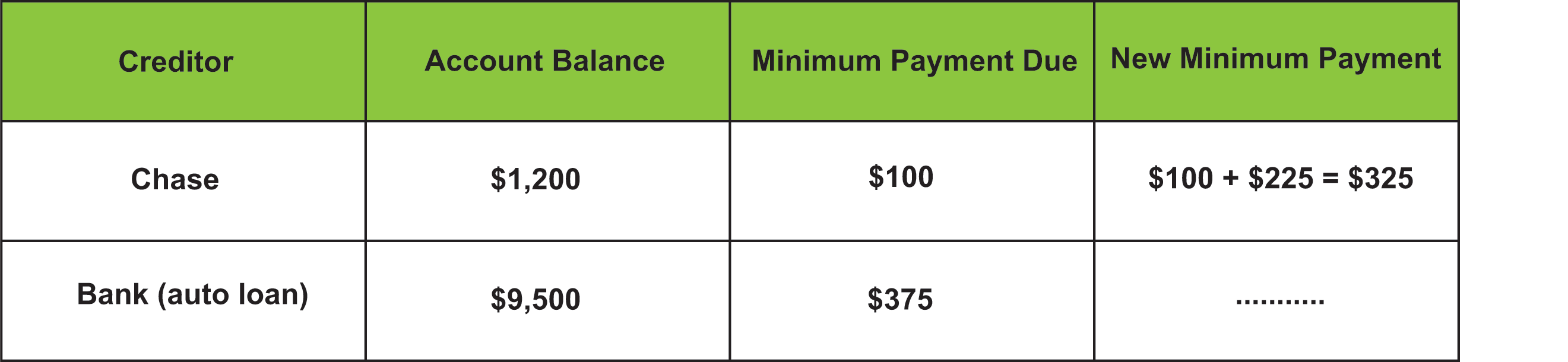

With your first debt eliminated, take the monthly amount you paid on it and add it to the minimum payment of your next lowest debt.

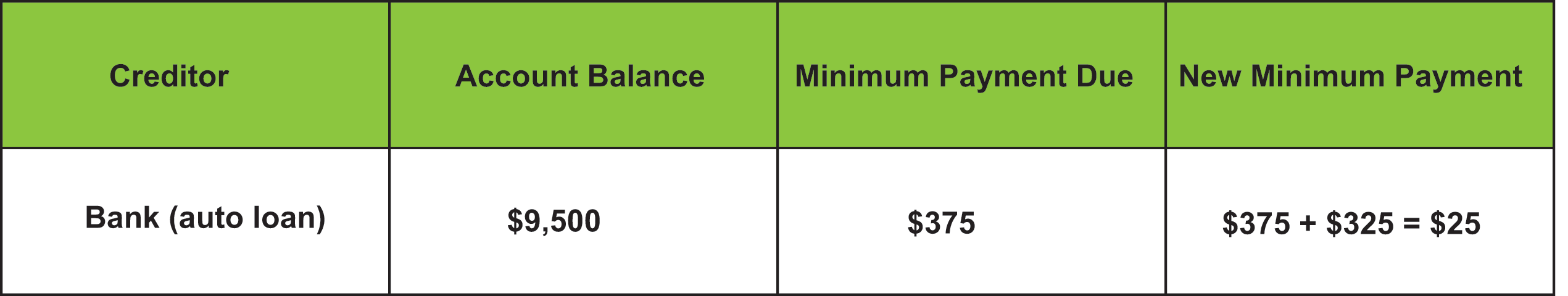

So, now you’re paying $325 to Chase. Continue to make your minimum payment of $375 to your bank for your auto loan. By making accelerated payments, the Chase account will be eliminated in just a few months, assuming you’ve stopped charging expenses to the account. Once that debt is paid, take the monthly amount paid and add it to your last debt — the auto loan.

Now your new car payment is $700, so you’re paying almost double what you previously were! Do you see how you’re able to snowball your payments and eliminate your debt by finding an extra $200?

Key Takeaway

While the debt snowball method might not always be the most mathematically efficient (as it doesn't prioritize high-interest debts first), its focus on psychological wins and building momentum makes it a very effective strategy for many people to become debt-free. If you need frequent positive reinforcement to stay motivated, the debt snowball could be the right path for you.