Adult Learners

Saving

Are you looking for the key to successful saving? Here it is—start now! No matter what life stage you’re in, make it a priority and a habit to save for emergencies, your future and big-ticket items.

Saving can mean putting money aside and investing, but it can also mean living more frugally and reducing your spending. Both are important if you want your savings account to grow.

Saving is critical for financial security and independence for your family. Many experts recommend saving at least 10-15 percent of your income; if that doesn’t seem doable, start contributing as much as possible on a regular basis and work your way up from there. Making savings a consistent action is what matters.

What should you save for?

- Emergencies. A financial safety net should be top priority so unexpected expenses won’t put you in a bind or put you into debt. It’s best to save three to six months’ of necessary living expenses in your emergency fund, but in the meantime aim to save at least $1,000 to cover minor bills and repairs. Put your money somewhere easily accessible, like an interest-bearing savings account or money market account.

- Retirement. Whether you’re 25 or 55, retirement should be on your mind. Take advantage of your employer’s 401(k) or other sponsored investment program, especially if they offer matching funds – that’s free money! At minimum, contribute enough to get the full company match.

- College. Consider making monthly contributions to the Oklahoma 529 College Savings Plan. Participation in the Oklahoma 529 offers several savings perks, including an Oklahoma income tax deduction on contributions and tax-free growth and withdrawals. Visit Oklahoma529.com.

-

Wants. If you’d like a vacation, new car, home or any other big-ticket item, begin saving for it. Paying cash for expensive items versus using credit will save you hundreds or thousands of dollars. The more money you can save, the less you’ll pay in the form of interest.

Imagine you use credit to buy a TV for $1,000. If you made only the required minimum monthly payment and your credit card charges an 18 percent annual interest rate, it would take eight years to pay off that debt, and you’d pay an additional $684 in interest!

Cut back, move forward

Trimming spending on wants and other unnecessary items can help you get one step closer to your savings goal. Thankfully, living a more frugal lifestyle doesn’t have to mean sacrifice. If you’re married or in a committed relationship, talk with your partner about your financial goals. Maybe you’d like to retire and travel at 55 or you’d enjoy paying cash for your next car or home. These goals will take dedication and planning. Once you’ve determined your joint financial goals, ask yourselves:

- When do we want to reach this goal?

- What are we willing to sacrifice to reach it?

- How will we reduce our spending?

It all adds up

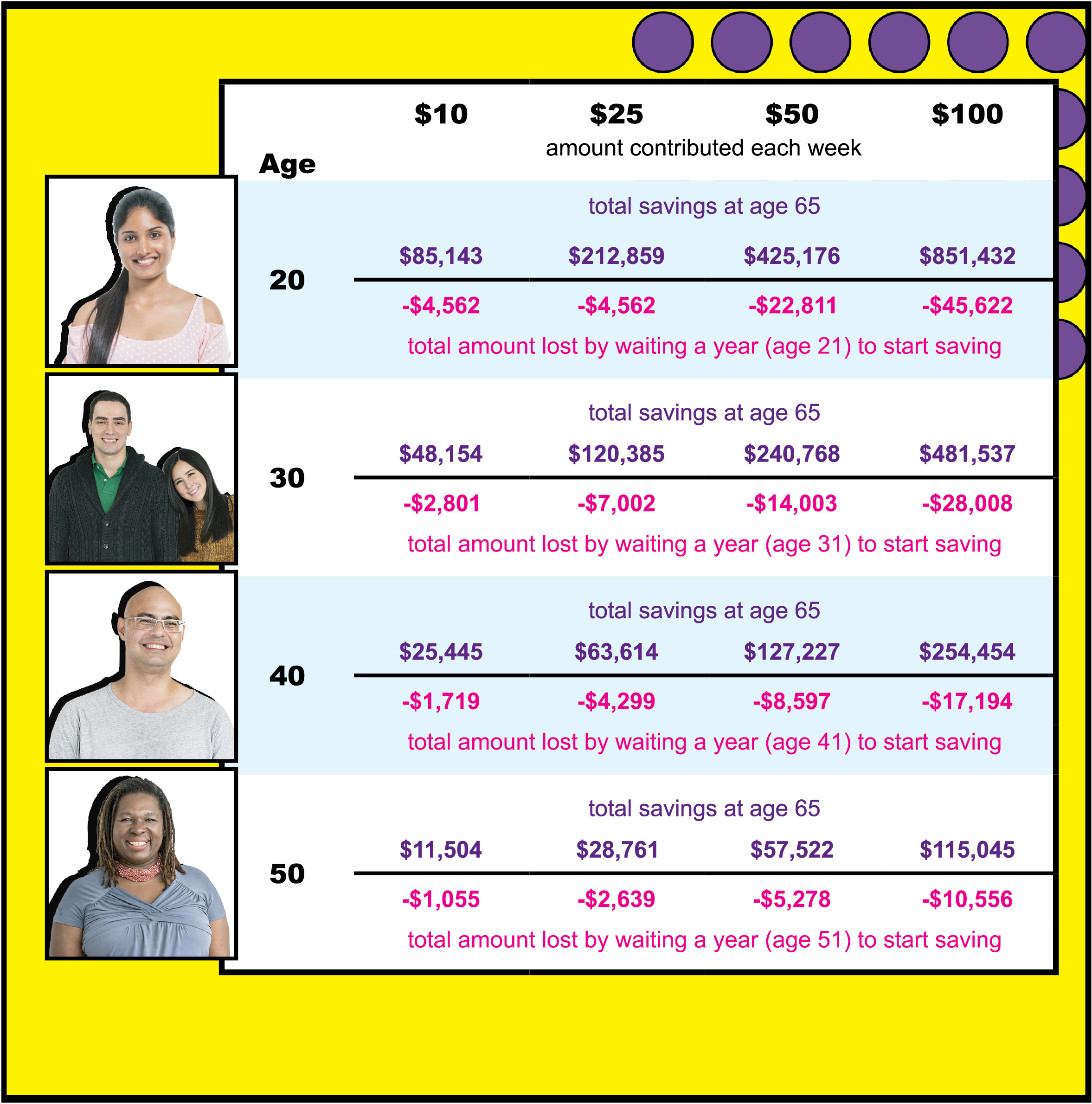

The more money you save and the earlier you begin saving, the more your money will grow with the help of compounding interest. Compounding interest is free money! It’s what you get when interest earned on your savings is added to the principal and you earn even more interest on that larger amount. The longer you save, the more compounding interest works in your favor.

The chart below shows how large your account can grow by age 65, depending on the age you begin saving and the amount saved weekly. For example, if you start saving $50 a week at age 30, you’ll have nearly half a million dollars by age 65. Imagine how much you’d have if you saved $100 a week!

More saving strategies

- Make it automatic. Each pay period, have money automatically transferred from your paycheck to your savings account. Direct deposit makes saving simple because you won’t miss what you don’t see.

- Adjust withholdings. Make sure your W-4 form is filled out to your best advantage. Submit a new W-4 anytime you experience a major life change, like a marriage or birth of a child, which can affect the amount of tax you’ll owe. If you receive a sizable tax refund each year, consider adjusting your withholdings so you can retain more of your income each month. Instead of giving Uncle Sam an interest-free loan, put that money in savings so it can benefit you.

- Put away windfalls. When you earn a raise, receive a refund or cash gift, save it. You can get by without the extra money, so put it toward your saving goals.

- Ask for a discount. Whether you’re buying a gym membership, hotel stay, car insurance or beauty treatment, ask for a discount. Asking doesn’t hurt and you never know—they may just grant your request.

- Re-evaluate service providers. Routinely compare auto and home insurance providers to make sure you’re getting the best rate. You may receive a significant discount if you bundle policies with the same company. Also, some providers offer discounts if you work for specific employers or within a particular industry.